CDFI Funding Landscape and Other CDFI News

It is unclear where the Trump administration stands on the CDFI Fund. From the American Banker (click on link below for article, subscription required):

OFN is leading members and other CDFI champions in a campaign to educate a new Congress about the CDFI industry. Using #CDFIsInvest, they will shine a spotlight on the various ways CDFIs invest in communities and individuals and will urge Congress to support $250 million in CDFI Fund funding for both FY17 and FY18. Also, the CDFI Fund put out a notice on a request for comments on the requirements to achieve and maintain certification as a CDFI. The CDFI Coalition sent a letter to the fund on this subject in May 2016, which was based on feedback from the membership. Comments are due March 10th. Finally, Senator Deb Fischer (R-NE) introduced the Microloan Modernization Act of 2017. This legislation raises lending caps on intermediaries from $5M to $6M and eliminates the 25/75 rule. It also requires an SBA study on microenterprise participation and a GAO study on microloan intermediary practices. CAMEO worked hard on this bill and will continue to work toward its passage.Some worry that the fund could be viewed as discretionary spending, making it a prime candidate for cuts. At the same time, President Donald Trump has talked about creating jobs and revitalizing inner cities that often benefit from CDFI activity.

The CalCAP Program, Changes and a Bill

The California Pollution Control Financing Authority (CPCFA) is proposing changes to the CalCAP program. CAMEO member lenders discussed these changes in a call in December. Opportunity Fund’s analysis indicates that the changes would have profound impact on how the program works. The changes are also being applied to all of CPCFA’s programs such as the ADA program and the seismic saftey program. Concerns were expressed to the CPCFA board and we are waiting for their new recapture regulations, which must be passed by the end of March. In the meanwhile, Senator Ben Hueso of San Diego introduced SB 551 (Hueso), sponsored by Opportunity Fund. Please join us in supporting SB 551. Support letters and other information are on our blog post – “Capital Access Loan Program for Small Business.”MMS Grows for Fourth Year in a Row!

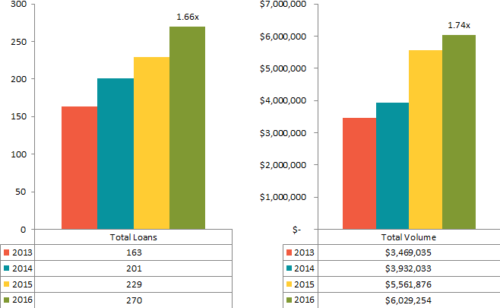

CAMEO’s MMS program is in it’s fourth full year. Since the inception of the program, the number of loans has increased by 166% and the loan volume by 177%. In 2016, lending grew by 38% across the entire cohort. MMS users made 186 loans in 2016, for a total loan volume of $3.6 million. The average loan size was $19,512.

Read the blog post by Andrew Seko for more details.

Contact Susan Brown if you’re interested in learning more about how you can increase capital access in your community through CAMEO’s MMS program. MMS, licensed through LiftFund, provides instant risk assessment and fast, quality underwriting to support microlenders in scaling up and maintaining strong portfolio performance.

CAMEO’s MMS program is in it’s fourth full year. Since the inception of the program, the number of loans has increased by 166% and the loan volume by 177%. In 2016, lending grew by 38% across the entire cohort. MMS users made 186 loans in 2016, for a total loan volume of $3.6 million. The average loan size was $19,512.

Read the blog post by Andrew Seko for more details.

Contact Susan Brown if you’re interested in learning more about how you can increase capital access in your community through CAMEO’s MMS program. MMS, licensed through LiftFund, provides instant risk assessment and fast, quality underwriting to support microlenders in scaling up and maintaining strong portfolio performance.

MicroLenders Forum Recap

This year’s MicroLenders Forum concentrated on the use of technology in microlending – tools to do the lending and a way to close the bank referral loop. We are grateful to the Federal Reserve Bank of San Francisco for hosting us (that’s their lobby in the photo).

Our program included: opportunities to scale up your microlending activities with new technologies; exciting new programs from CAMEO to build capacity of both your staff and your portfolio; and a new program to increase bank referrals. We had a surprise visit from Jose’ Cisneros, Treasure of San Francisco. nd of course we shared accomplishments and challenges and enjoyed our time together, especially at Happy Hour!

Read the recap (and download presentations) of the “2017 MicroLenders Forum.”

Research: USDA Microloans for Farmers: Participation Patterns and Effects of Outreach

U.S. Department of Agriculture, Farm Service Agency’s (FSA) Microloan program, launched in 2013, aims to better serve the credit needs of several types of farmers: small, beginning, veteran, and/or from historically socially disadvantaged groups (women and minorities). The report investigates the composition of Microloan borrowers and the receipt of these loans by new FSA borrowers.

Farmers belonging to targeted groups received 89 percent of all Microloans, of which beginning farmers accounted for the majority, at 81 percent of all Microloans. SDA farmers accounted for 35 percent of all Microloans, and 79 percent of those were received by borrowers who were also beginning farmers.

U.S. Department of Agriculture, Farm Service Agency’s (FSA) Microloan program, launched in 2013, aims to better serve the credit needs of several types of farmers: small, beginning, veteran, and/or from historically socially disadvantaged groups (women and minorities). The report investigates the composition of Microloan borrowers and the receipt of these loans by new FSA borrowers.

Farmers belonging to targeted groups received 89 percent of all Microloans, of which beginning farmers accounted for the majority, at 81 percent of all Microloans. SDA farmers accounted for 35 percent of all Microloans, and 79 percent of those were received by borrowers who were also beginning farmers.

Research: Measuring the Representation of Women and Minorities in the SBIC Program

The U.S. Small Business Administration (SBA) oversees the Small Business Investment Company (SBIC) Program, which provides an alternative source of financing for high-risk small businesses lacking access to adequate capital from traditional sources. Since the program’s inception in 1958 through December 2015, SBICs have deployed US $80.5 billion in capital (two-thirds from the private sector) into approximately 172,800 financings. This report examines gender and racial diversity in the venture-capital (VC) and private-equity (PE) arenas from the SBIC Program, and asks whether diverse SBICs are more likely to invest in diverse portfolio companies or in low- and moderate-income communities. One of the key findings: The racial and gender makeup of investment boards is tied directly to the investment decisions they make, especially when it comes to funding companies led by people of color or female founders.News

- Will traditional bank lending pull back even more from small business lending?

- The Office of the Comptroller of the Currency’s plan to offer a federal charter for fintech companies is facing a challenge from two top Senate Democrats.

- Another online lender – Bond Street.

- To realize their potential, crowdfunding efforts need to engage traditionally excluded communities by emphasizing more than one bottom line.

- In February, the House Committee on Financial Services held a hearing that examined and discussed authorization and oversight of the Dodd-Frank Wall Street Reform and Consumer Protection Act.