MEDA Receives First Carrot Fund Loan

New CAMEO Programs: Loan Manual and Training

Federal Budget Updates for Micro, and

Federal Small Business Loan Data Under Attack

California Policy Updates: COIN and CalCAP

Opportunity Fund and Lending Club’s Collaboration

Research: CDFI Loan Fund Technology Landscape: User Survey Results

News

MEDA Receives First Carrot Fund Loan

CAMEO’s Carrot Fund was established to provide capital to nonprofit lenders in California that need small tranches of investment to service their pipeline of borrowers, with the goal of increasing capital access in under-served, low- and moderate-income communities. The Fund is targeted to the newer and smaller organizations that desire to grow capacity. In addition to capital, CAMEO provides expert technical assistance to Fund applicants. The Carrot Fund will build strength and capacity in its nonprofit lenders as measured by:

- increased loan volume

- increased capacity to manage borrowed loan funds

- technology adoption

- improved underwriting consistency

- improved management information systems and reporting

- improved portfolio performance

Recently Mission Economic Development Agency’s Adelante Fund became the first recipient of a $200,000 investment, which will be used to fund demand for micro loans only.

New CAMEO Programs: Loan Manual and New Training

The high-volume, successful lenders in our network have clear lending strategies based on their mission and financial acumen. They have created solid operations manuals and policies that are consistent with their strategy and lending expertise.

A mission-based lender needs a complete, well-reasoned loan manual in order to support its full growth and performance potential. CAMEO recognized this need and is currently developing a workbook to assist our member lenders to create a useful loan policies manual. Stay tuned for this workbook and related workshops to support implementation.

A key to building micro lending capacity is CAMEO’s Microlending Essentials Training, which will be offered for the first time on

November 7-9, 2017 in Los Angeles. This new intensive training program is for staff who want to learn the difference between micro and small business lending and to do it right. More details are forthcoming and early bird registration will open soon.

Federal Budget Updates for Micro

So far we have initial numbers for the the CDFI Fund and some microloan programs. The House Financial Services & General Government (FSGG) Appropriations Subcommittee funded the CDFI Fund at $190 million (FY 2017 was $250 million), and Microloan Technical Assistance was funded at $31 million (which is the FY 2017 number). The full Appropriations Committee votes on the budget tomorrow and the full House at a later dates, so

there’s still time for amendments. The good news is that the President zeroed out the CDFI Fund and there’s still the Senate. The CDFI Fund needs your help. Please write a letter to your Congress people and visit them if you can!

Find contact information for your

representative and Senators

Diane Feinstein and

Kamala Harris by clicking on the links.

Here are some resources to help you:

Federal Small Business Loan Data Under Attack

Also, in the House FSGG draft appropriations bill was the repeal of section 704B of the Equal Credit Opportunity Act (section on loan application reporting).

Additinally, the House passed the Financial Choice Act, which included the repeal of collecting small business lending data (among other bad provisions). The Treasury Department and the Acting OCC Comptroller also questioned the benefit of collecting small business loan information.

Such data have existed for home mortgage lending for years and that data transparency has led to better and more fair lending by mortgage lenders. The purpose of small business lending data will identify lending needs, help local governments to allocate resources, and to help identify possible discrimination.

The Consumer Financial Protection Bureau will begin

collecting information on small business lending practices from lenders across the U.S. and are asking for input about how and why this information should be collected.

Ways business assistance providers and microlenders can be involved:

- Submit a comment directly to the CFPB before the deadline on September 14, 2017.

- The California Reinvestment Coalition has a survey – CRC Small Business Lending Survey – that will help develop a letter to send to the powers that be.

- It is critical that your client’s voices are heard! Ask your clients to weigh in – you can reach out to them directly or ask them to complete these brief surveys by Opportunity Fund (English, Spanish).

California Policy Updates: COIN and CalCAP

COIN Update: Unfortunately, the Brown Administration firmly opposed additional expenditures and tax credits. As a result, the COIN extension will not be included in the final budget this year. CAMEO will work with our allies on this issue as well. Impact stories on how COIN has supported your organization and small businesses would be very useful in this endeavor. Start to gather them and I’ll be hitting you up individually.

CalCAP: Senator Ben Hueso of San Diego introduced

SB 551 (Hueso), sponsored by Opportunity Fund to ensure the sustainability of the CalCAP program. The bill is now in the Assembly Banking and Finance Committee.

Please join us in supporting SB 551. Support letters and other information are on our blog post – “

Capital Access Loan Program for Small Business.”

Opportunity Fund and Lending Club’s Collaboration

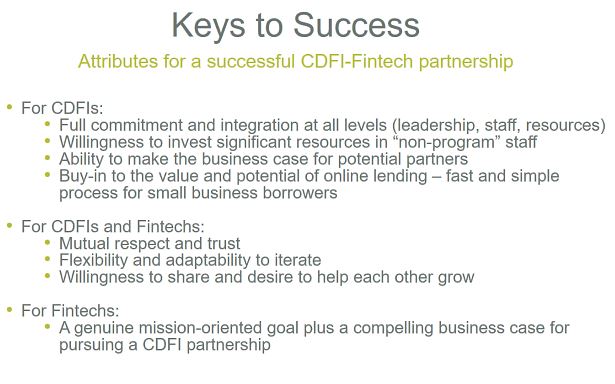

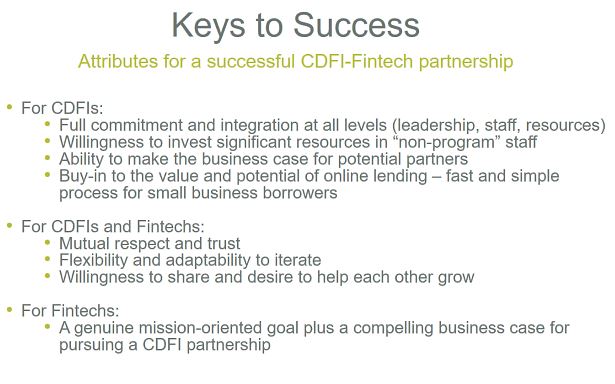

Opportunity Fund has forged a cross-sector collaboration with Lending Club, the largest online marketplace, and Craft3, a peer CDFI, to expand access to capital for small businesses and do community lending. Last month, they held a webinar to discuss challenges they faced and the lessons learned.

The partnership was conceived at the Clinton Global Initiative 2015, then the groups developed a relationship by working together on the Borrowers’ Bill Of Rights, and by the end of 2015 they received funding from JPMorgan Chase Foundation and their PRO Neighborhoods Initiative. The seed funding for this collaboration was to figure out how to harness effectively the best of “high-touch” and “high-tech” lending to increase access to capital for inclusive growth.

Lending Club would use their substantial marketing budget that attracts a sizeable portion of the small business lending demand and the CDFIs would offer the high touch experience for which they are known. The group learned that speed was THE most important factor in a small business owner’s decision to accept a loan offer.

Initially, if the borrower received a rejection from Lending Club, he/she would receive an email introduction to their partner Opportunity Fund. That was not as efficient or effective as it could have been and led to an integration of the lead generation into a seamless customer experience. The process of developing the program took 18 months, during which Opportunity Fund decided they needed an in-house Chief Info Officer. The program is now in 12 states, expanding by 14 additional in Fall 2017.

The chart above shows what it takes to have such a successful partnership.

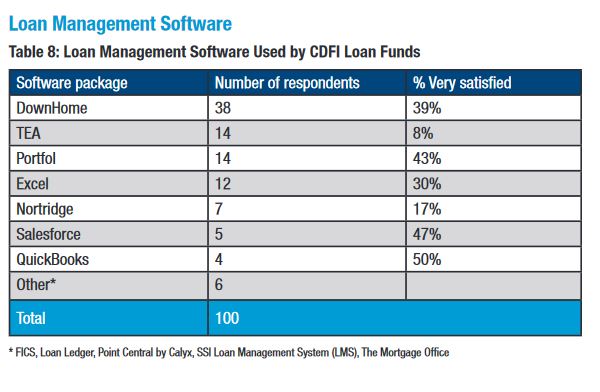

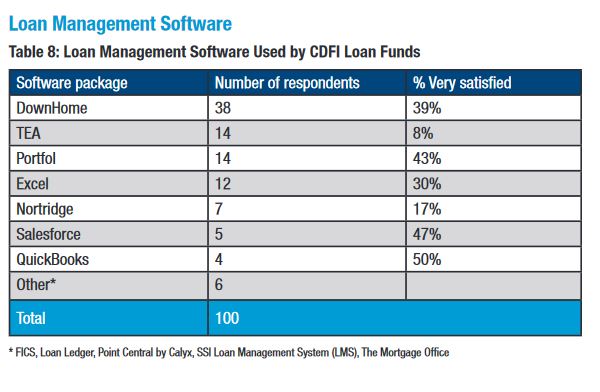

Research: OFN’s CDFI Loan Fund Technology Landscape: User Survey Results

Based on OFN’s 2016 survey of 100 CDFI loan funds, the report explores

common software solutions used by loan funds—including customized spreadsheets and databases and popular mainstream programs like Excel, QuickBooks, and Salesforce—and provides user feedback on them.

As technology has become an essential tool in the support of CDFI operations, CDFIs need to understand the performance factors of these different programs. This CDFI Loan Fund Technology Landscape provides useful insight into different solutions that can help CDFIs exploring new technology options.

News

]]>

CAMEO’s Carrot Fund was established to provide capital to nonprofit lenders in California that need small tranches of investment to service their pipeline of borrowers, with the goal of increasing capital access in under-served, low- and moderate-income communities. The Fund is targeted to the newer and smaller organizations that desire to grow capacity. In addition to capital, CAMEO provides expert technical assistance to Fund applicants. The Carrot Fund will build strength and capacity in its nonprofit lenders as measured by:

CAMEO’s Carrot Fund was established to provide capital to nonprofit lenders in California that need small tranches of investment to service their pipeline of borrowers, with the goal of increasing capital access in under-served, low- and moderate-income communities. The Fund is targeted to the newer and smaller organizations that desire to grow capacity. In addition to capital, CAMEO provides expert technical assistance to Fund applicants. The Carrot Fund will build strength and capacity in its nonprofit lenders as measured by:

The high-volume, successful lenders in our network have clear lending strategies based on their mission and financial acumen. They have created solid operations manuals and policies that are consistent with their strategy and lending expertise.

A mission-based lender needs a complete, well-reasoned loan manual in order to support its full growth and performance potential. CAMEO recognized this need and is currently developing a workbook to assist our member lenders to create a useful loan policies manual. Stay tuned for this workbook and related workshops to support implementation.

A key to building micro lending capacity is CAMEO’s Microlending Essentials Training, which will be offered for the first time on November 7-9, 2017 in Los Angeles. This new intensive training program is for staff who want to learn the difference between micro and small business lending and to do it right. More details are forthcoming and early bird registration will open soon.

The high-volume, successful lenders in our network have clear lending strategies based on their mission and financial acumen. They have created solid operations manuals and policies that are consistent with their strategy and lending expertise.

A mission-based lender needs a complete, well-reasoned loan manual in order to support its full growth and performance potential. CAMEO recognized this need and is currently developing a workbook to assist our member lenders to create a useful loan policies manual. Stay tuned for this workbook and related workshops to support implementation.

A key to building micro lending capacity is CAMEO’s Microlending Essentials Training, which will be offered for the first time on November 7-9, 2017 in Los Angeles. This new intensive training program is for staff who want to learn the difference between micro and small business lending and to do it right. More details are forthcoming and early bird registration will open soon.

So far we have initial numbers for the the CDFI Fund and some microloan programs. The House Financial Services & General Government (FSGG) Appropriations Subcommittee funded the CDFI Fund at $190 million (FY 2017 was $250 million), and Microloan Technical Assistance was funded at $31 million (which is the FY 2017 number). The full Appropriations Committee votes on the budget tomorrow and the full House at a later dates, so there’s still time for amendments. The good news is that the President zeroed out the CDFI Fund and there’s still the Senate. The CDFI Fund needs your help. Please write a letter to your Congress people and visit them if you can!

Find contact information for your representative and Senators Diane Feinstein and Kamala Harris by clicking on the links.

Here are some resources to help you:

So far we have initial numbers for the the CDFI Fund and some microloan programs. The House Financial Services & General Government (FSGG) Appropriations Subcommittee funded the CDFI Fund at $190 million (FY 2017 was $250 million), and Microloan Technical Assistance was funded at $31 million (which is the FY 2017 number). The full Appropriations Committee votes on the budget tomorrow and the full House at a later dates, so there’s still time for amendments. The good news is that the President zeroed out the CDFI Fund and there’s still the Senate. The CDFI Fund needs your help. Please write a letter to your Congress people and visit them if you can!

Find contact information for your representative and Senators Diane Feinstein and Kamala Harris by clicking on the links.

Here are some resources to help you:

COIN Update: Unfortunately, the Brown Administration firmly opposed additional expenditures and tax credits. As a result, the COIN extension will not be included in the final budget this year. CAMEO will work with our allies on this issue as well. Impact stories on how COIN has supported your organization and small businesses would be very useful in this endeavor. Start to gather them and I’ll be hitting you up individually.

CalCAP: Senator Ben Hueso of San Diego introduced SB 551 (Hueso), sponsored by Opportunity Fund to ensure the sustainability of the CalCAP program. The bill is now in the Assembly Banking and Finance Committee.

Please join us in supporting SB 551. Support letters and other information are on our blog post – “Capital Access Loan Program for Small Business.”

COIN Update: Unfortunately, the Brown Administration firmly opposed additional expenditures and tax credits. As a result, the COIN extension will not be included in the final budget this year. CAMEO will work with our allies on this issue as well. Impact stories on how COIN has supported your organization and small businesses would be very useful in this endeavor. Start to gather them and I’ll be hitting you up individually.

CalCAP: Senator Ben Hueso of San Diego introduced SB 551 (Hueso), sponsored by Opportunity Fund to ensure the sustainability of the CalCAP program. The bill is now in the Assembly Banking and Finance Committee.

Please join us in supporting SB 551. Support letters and other information are on our blog post – “Capital Access Loan Program for Small Business.”

Opportunity Fund has forged a cross-sector collaboration with Lending Club, the largest online marketplace, and Craft3, a peer CDFI, to expand access to capital for small businesses and do community lending. Last month, they held a webinar to discuss challenges they faced and the lessons learned.

The partnership was conceived at the Clinton Global Initiative 2015, then the groups developed a relationship by working together on the Borrowers’ Bill Of Rights, and by the end of 2015 they received funding from JPMorgan Chase Foundation and their PRO Neighborhoods Initiative. The seed funding for this collaboration was to figure out how to harness effectively the best of “high-touch” and “high-tech” lending to increase access to capital for inclusive growth.

Lending Club would use their substantial marketing budget that attracts a sizeable portion of the small business lending demand and the CDFIs would offer the high touch experience for which they are known. The group learned that speed was THE most important factor in a small business owner’s decision to accept a loan offer.

Initially, if the borrower received a rejection from Lending Club, he/she would receive an email introduction to their partner Opportunity Fund. That was not as efficient or effective as it could have been and led to an integration of the lead generation into a seamless customer experience. The process of developing the program took 18 months, during which Opportunity Fund decided they needed an in-house Chief Info Officer. The program is now in 12 states, expanding by 14 additional in Fall 2017.

The chart above shows what it takes to have such a successful partnership.

Opportunity Fund has forged a cross-sector collaboration with Lending Club, the largest online marketplace, and Craft3, a peer CDFI, to expand access to capital for small businesses and do community lending. Last month, they held a webinar to discuss challenges they faced and the lessons learned.

The partnership was conceived at the Clinton Global Initiative 2015, then the groups developed a relationship by working together on the Borrowers’ Bill Of Rights, and by the end of 2015 they received funding from JPMorgan Chase Foundation and their PRO Neighborhoods Initiative. The seed funding for this collaboration was to figure out how to harness effectively the best of “high-touch” and “high-tech” lending to increase access to capital for inclusive growth.

Lending Club would use their substantial marketing budget that attracts a sizeable portion of the small business lending demand and the CDFIs would offer the high touch experience for which they are known. The group learned that speed was THE most important factor in a small business owner’s decision to accept a loan offer.

Initially, if the borrower received a rejection from Lending Club, he/she would receive an email introduction to their partner Opportunity Fund. That was not as efficient or effective as it could have been and led to an integration of the lead generation into a seamless customer experience. The process of developing the program took 18 months, during which Opportunity Fund decided they needed an in-house Chief Info Officer. The program is now in 12 states, expanding by 14 additional in Fall 2017.

The chart above shows what it takes to have such a successful partnership.

Based on OFN’s 2016 survey of 100 CDFI loan funds, the report explores common software solutions used by loan funds—including customized spreadsheets and databases and popular mainstream programs like Excel, QuickBooks, and Salesforce—and provides user feedback on them.

As technology has become an essential tool in the support of CDFI operations, CDFIs need to understand the performance factors of these different programs. This CDFI Loan Fund Technology Landscape provides useful insight into different solutions that can help CDFIs exploring new technology options.

Based on OFN’s 2016 survey of 100 CDFI loan funds, the report explores common software solutions used by loan funds—including customized spreadsheets and databases and popular mainstream programs like Excel, QuickBooks, and Salesforce—and provides user feedback on them.

As technology has become an essential tool in the support of CDFI operations, CDFIs need to understand the performance factors of these different programs. This CDFI Loan Fund Technology Landscape provides useful insight into different solutions that can help CDFIs exploring new technology options.